Arthur D. Little looks at the recent development of the Chinese commercial aircraft industry and highlights the important areas for aerospace companies to watch.

For the global aeronautical industry, China represents the largest commercial opportunity of the coming 10 years, and the biggest competitive threat for the decades to follow. Arthur D. Little reviews the development of the Chinese aeronautical industry, which recently accelerated with the creation of COMAC and AECC, and identifies the key aspects to be closely monitored by Western players.

1. China wants to leverage its growing domestic demand to become a global leader in commercial airplanes

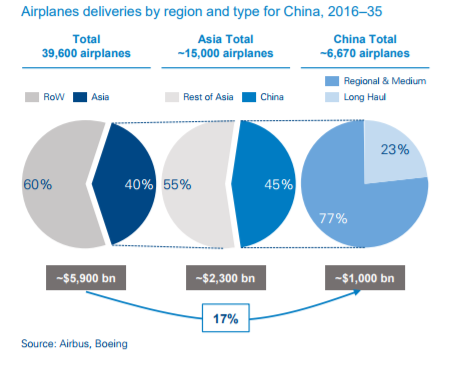

The Chinese commercial aircraft market represents a 1 trillion-dollar opportunity over the next 20 years. The Chinese aeronautical market is booming. According to Airbus and Boeing, China will account for 17% of the 40,000 global airplane deliveries expected during the next 20 years. It is considered the largest market, valued at $1 trillion cumulatively.

The Chinese government decided to structure a domestic commercial-aircraft manufacturing industry capable of reducing its dependency on foreign suppliers and, in the long term, of competing with established OEMs on a global scale.

- Thanks to massive governmental support, the Chinese aeronautical industry is progressively emerging, centered on AVIC and COMAC

Between the 1950s and the early 1980s, the Chinese aeronautical industry mainly focused on the development of military aircraft and a few unsuccessful attempts at manufacturing commercial jet aircraft (e.g., Shanghai Y-10). In 1985, the partnership established with McDonnell Douglas represented a major turning point, accelerating the Chinese industry’s learning process through the joint manufacturing of the MD-82. The creation of the Aviation Industry Corporation of China (AVIC) in the 1990s and the Commercial Aircraft Corporation of China (COMAC) in the 2000s initiated a phase of consolidation for Chinese industrial capabilities, aimed at developing a full range of commercial jet aircraft. In parallel with developing COMAC as the domestic OEM, the Chinese government invested in building a local supply chain and requested Western players that were willing to capture contracts in China to partner with the local industry, operating transfers of know-how and technologies.

The first results of this strategy are visible in the aerostructures market, where AVIC has developed into a leading tier-1 supplier to all major OEMs. On top of aerostructures, the Chinese government recently started to invest in Aero Engine Corp. of China (AECC) to develop domestic industrial capabilities for the manufacturing of aircraft engines. To a lesser extent, it also invested in the joint venture between AVIC and GE (AVIAGE Systems) to develop avionics systems.

2. COMAC is currently working on four aircraft development programs at different levels of maturity

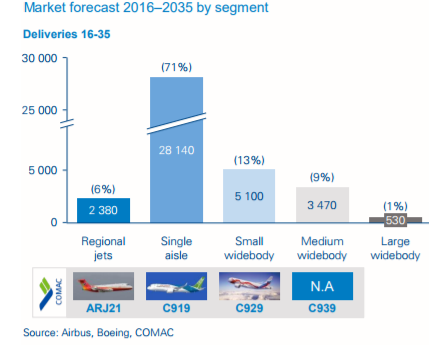

COMAC inherited, at its creation, the ARJ21 program and, in the early 2010s, kicked off three other development programs – C919, C929 and C939 – to enter different market segments.

- ARJ21: after significant delays, the focus is now on solving quality issues and ramping up production

A key project in the “10th Five-Year Plan” (2001-2005) of China, the development of the ARJ21, started in 2002. This project experienced significant delays compared to the initial plan: the first commercial flight took place in June 2016, six years later than planned, and only two ARJ21 aircraft had been delivered as of February 2017 (both to Chengdu Airlines, a company owned by COMAC). Depending on the version, the ARJ21 has a maximum seating capacity of 105 and a maximum range of 3,700 km, which makes it a direct competitor to Embraer E175 and E190, as well as to Bombardier CRJ900 and CRJ1000. COMAC, Embraer and Bombardier use variants of the same GE CF34 engine.

- C919: starting to compete with Airbus A320 and Boeing 737 in the medium-haul segment

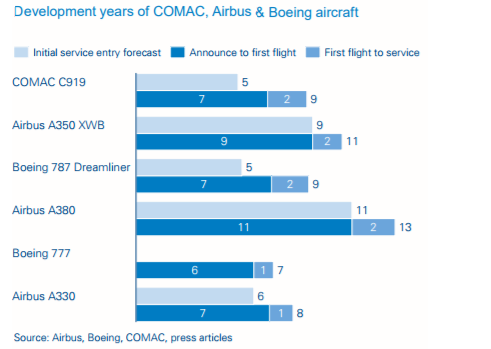

A core element of the Chinese aeronautical strategy, the C919 gives access to the medium-haul segment, which is expected to generate most aircraft deliveries over the coming two decades. Launched in 2010, this program leverages the experience gained on ARJ21 and officially targets its first deliveries in 2019. This narrow-body, twin-engine aircraft targets a capacity between 158 and 174 seats and a maximum range of 5,500 km. Despite significant delays compared to the initial timeline (which, however, seem quite common in the development of comparable airplanes, as highlighted in Figure below), the C919 performed its maiden flight on May 5th, 2017, and is expected to enter into service in 2020–2021

- C929 and C939: developing long-haul aircraft targeting commercial services after 2025

COMAC recently initiated the development of two long-haul aircraft to further extend its product range:

- C929 – With 280 seats and a range of 12,000 km, this wide-body, twin-engine aircraft will compete against the Airbus A350 and the Boeing 787. Its first flight is scheduled in 2023, with commercial service in 2026. This aircraft will be jointly developed by COMAC and Russia’s United Aircraft Corporation (UAC).

- C939 – With 400 seats, this long-range, wide-body aircraft is intended to compete against the Boeing 777 and 747 and the Airbus A350 and A380. No schedule has been published so far.

- Scaling up production is the key priority for COMAC to address the growing demand in the Chinese market, but definitively, it will not be enough to expand internationally

In order to capture the domestic demand, COMAC must scale the production and delivery of its ARJ21, as well as its C919 airplanes once they enter into service.

The key question today is how long it will take for COMAC to fix the initial quality issues (e.g. on the ARJ21) and scale up the production to a few dozen aircraft delivered per month – a level comparable to A320 and 737 production lines?

Our international-airline customers, both legacy and low-cost, agree that COMAC will need to develop a wide range of additional assets on the ground for them to consider introducing the C919 in their fleets. For example, a wide MRO network and robust sales & marketing capabilities are considered “must haves”.

- Obtaining certifications might slow COMAC export to Western countries, but this appears less of an issue in developing markets

Obtaining aircraft certifications from the National Aviation Authorities in Europe and in the US might prove a challenging and long process for COMAC. For example, for the time being, US authorities do not allow importing of Chinese-made aircraft, except for the Harbin Y-10. However, according to Arthur D. Little intelligence, COMAC benefits from a large and growing domestic market and an addressable export market in many countries, which are already purchasing Chinese civil and military aircraft.

- Today, COMAC’s industrial model and supplier base are similar to those of Airbus and Boeing

The industrial model of COMAC is comparable to Airbus and Boeing, focusing on the design and assembly of parts and systems procured from the global aeronautical supply chain. AVIC is one of the main tier-1 suppliers selling aerostructures to COMAC, while all the others are typical Western aeronautical suppliers (e.g., GE, Safran, Honeywell, Rockwell Collins). In-house manufacturing is limited to very specific aerostructure components (e.g., empennage).

3. On top of COMAC and AVIC, the Chinese government is investing in domestic aircraft engine manufacturers

In its “Made in China 2025” industrial policy presented in 2015, the Chinese government identified aircraft engines as one of the 10 crucial manufacturing sectors of importance.

In order to steer the development of this sector, a new stateowned entity was created in 2016 with the objective of building a world-class jet engine. This new entity, called the Aero Engine Corp. of China (AECC), consolidates all existing Chinese engine manufacturers. With its 46 subsidiaries and 96,000 employees, AECC is responsible for the R&D and manufacturing of aircraft engines and gas turbines.

This strategic move aims at strengthening the Chinese aviation industry by reducing its reliance on foreign suppliers. AECC plans to build engines that can replace foreign-made engines on the ARJ21 and the C919.

4. China has demonstrated its capacity to grow as a global leader in other industrial sectors

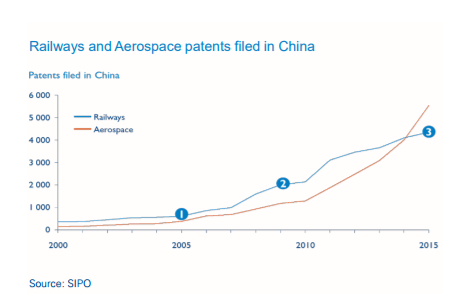

China became a global leader in the high-speed trains sector (also) thanks to technology transfers from top players Starting in the 1990s, leading high-speed train manufacturers such as Siemens and Kawasaki were asked to partner with the local industry and operate technology transfers as a condition of commercializing their products in the Chinese market. Figure below compares the evolution of patenting activity in China between the railway and aerospace sectors, and highlights three relevant turning points in the development of the local high-speed train sector:

- In 2005 a joint venture was established between Siemens and CNR for the transfer of high-speed train technology.

- In 2009 a $5.7bn contract was awarded to CNR for the manufacturing of 100 trains for Beijing – for Shanghai highspeed railway, $1bn was subcontracted to Siemens.

- In 2015 CNR was competing with the major high-speed train manufacturers, including Siemens, on a global scale. Deutsche Bahn publicly stated that it was considering buying trains and spare parts from Chinese producers.

As can be noted from the chart, Chinese players used patents to protect their intellectual property, either generated autonomously or received through technology transfers; this allowed them to create additional entry barriers to protect their domestic market.

In the aerospace sector, we notice a steep increase in the volume of patents filed in China, which grew more than four times over the last five years.

Based on our recent project experiences and discussions with industry leaders, we believe the Chinese government and aeronautical industry might be replicating the same approach adopted by the railway sector, progressively building barriers to reduce the ability of non-Chinese players to access the market.

5. Players along the whole aeronautics value chain should closely follow Chinese industry’s take-off

For the global aeronautical value chain, China represents the largest commercial opportunity of the coming 10 years, and the largest competitive threat for the decades to follow. Western players are facing a strategic dilemma:

- Should they support the Chinese industry in exchange for shares of this growing market, but with the risk of accelerating the development of new global competitors?

- Will the Chinese market remain accessible in the long run, even when the development of the local industry is completed?

The answer to these questions depends on the behavior of the different players in the Western aeronautical industry, and on the way in which the Chinese government decides to shape the domestic value chain. Should COMAC progressively shift to a “buy in China” model, Western aeronautical suppliers will lose access to a significant share of the market.

“Aeronautical leaders must closely monitor the development of COMAC and the overall Chinese aeronautical sector. They must also identify actions to ensure sustainable long-term access to the Chinese market and mitigate the threat of emerging new competitors.”

By Arthur D. Little: Consultancy