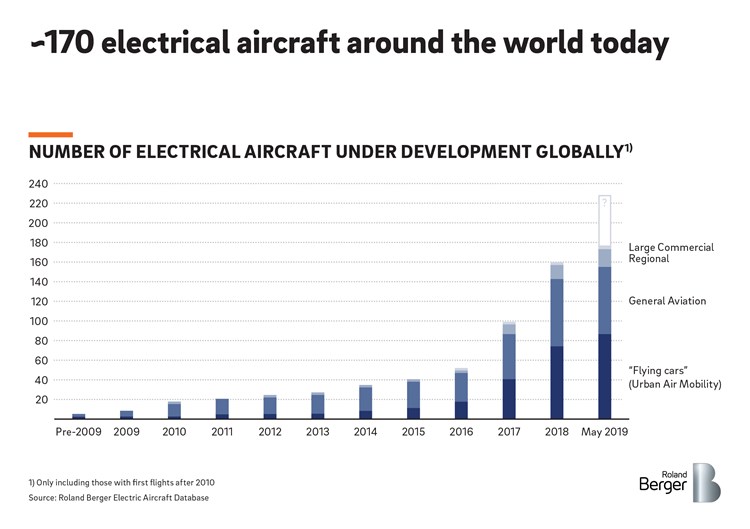

The number of electrically propelled aircraft around the world is pushing 170..

An industry-wide shift towards electrically-propelled aircraft is ongoing, and recent developments have only increased the momentum. Over the past several years, we at Roland Berger have been charting the trajectory of progress.

The number of electric aircraft announcements has grown rapidly in recent years, increasing at 50% p.a. since 2017 to c.170 developments in May 2019.

A pioneering spirit guides electric aircraft development and, emblematic of this, the rapid growth has been driven by entry of start-ups; they now constitute approximately 70% of aspiring OEMs in this market.

Another driver of growth has been the emergence of the urban air mobility trend. Urban air taxis (UATs) have grown fastest of all aircraft segments, at around 90% p.a. since 2016, and currently represent about 50% of all developments mapped.

As expected from this, the fastest growing platform type is the eVTOL (electric Vertical Take-Off and Landing) aircraft.

Spotlight on engines

Any discussion on electric aircraft would not be complete without consideration of the underlying engine technology, and we have made a number of observations on power source.

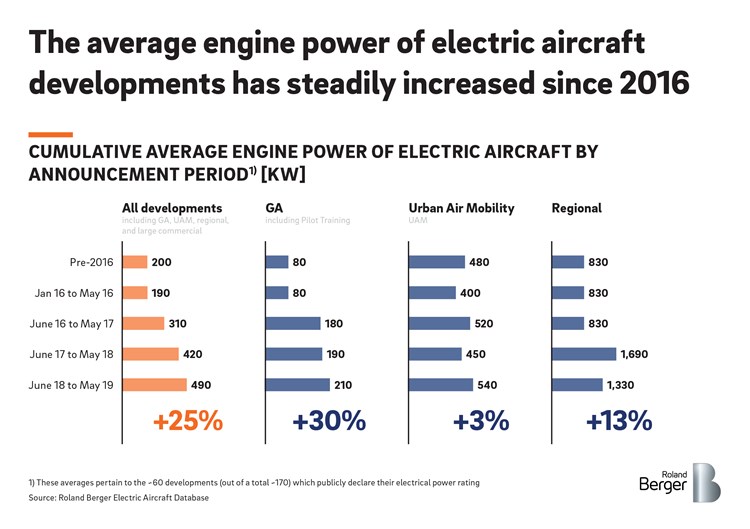

The average engine power of developments has increased, with an average of ~490kW in May this year. An increase in the proportion of regional aircraft, along with certain large announcements such as the Airbus E-Fan X, a hybrid-electric demonstrator anticipated to fly in 2020, have undoubtedly boosted the overall average. In fact, Airbus recently announced plans to test a 20 MW propulsion system.

However, we see that engine powers of the typically less powerful UAT and GA segments have broadly increased too. Regional aircraft, including business jets, have also seen an increase in engine power, with the announcement of the 4MW Zunum Aero model driving up the average in June 17 – May 18 (the average subsequently decreased with announcement of several less powerful aircraft).

The arrival of even bigger aircraft and more powerful propulsion technology will follow from growth in funding and advancement of technology maturity.

Advancement of battery technology will be one such driver. Current electrical systems technology still favours lower-power and shorter-distance flights, and, unsurprisingly, urban air taxis and general aviation projects dominate the c.110 battery-propelled developments. A battery gravimetric density of ~500 Wh/Kg is believed to be the minimum for viable aircraft that could one day be competitive with today’s propulsion systems for small regional and short-haul commercial flight; this is not expected to be in service before the mid-2030s at earliest.

Alternative single-power sources are also being explored, including solar and hydrogen fuel cells. An example of the latter is seen in Element One, a zero-emission regional hydrogen-electric aircraft announced by HES Energy Systems. A first flying prototype is targeted before 2025. Benefits of hydrogen-powered aircraft include long-range flying and fast recharge times, though hydrogen storage can be expensive and energy-intensive, especially when cryogenic cooling is required.

Regional and large commercial electrical aircraft concepts, such as Faradair’s 18-seat hybrid BEHA-MH1, tend to employ turbo-electric hybrid systems at present.

Divide and conquer: the benefits of distributed propulsion

Readers would be forgiven for thinking that hybrids are merely a ‘second-best’ option, yet the most efficient hybrid architectures are expected to deliver a 30-50% fuel efficiency improvement by leveraging the benefits of distributed propulsion.

Today, the power source and propulsion delivery of an aircraft are mechanically linked: in a conventional gas turbine, there is a shaft which connects the combustion chamber (the power source) to the bypass fan (the propulsion delivery). However, in electrical architectures, such as a series or turbo-electric hybrid, the mechanical connection can be removed, and only efficient cabling is required in its place.

In these architectures, there can still be an on-board gas turbine, which ultimately powers electric motors and a fan. The lack of a mechanical connection between power source and delivery allows for better overall optimisation of the propulsion system: the gas turbine can be optimised purely for electricity generation, while the propulsive devices can be optimised specifically for propulsion, increasing the overall efficiency (today they must be optimised together, hampered by each other’s limitations).

Importantly, there is no longer a need for the number of propulsive devices (fans) to equal the number of engines. The high cost and high maintenance gas turbine is decoupled from the propulsive devices, and there can be as many fans/propulsors/etc as required for optimal forward thrust. With more propulsive devices there is also greater redundancy in the system, and a greater chance to recover from hazards such as bird strikes. This potentially increases overall safety.

The shape of things to come

Perhaps most excitingly, distributed propulsion may spur on the creation of brand new aircraft architectures.

Distributed propulsion opens up the design space, and whilst additional fans could easily be introduced to help manage airflow around the aircraft, the biggest efficiency enhancements will come from completely reimagining aircraft architectures.

Features such as rear-mounted engines are already being explored, for example in the N3-X hybrid wing body designed by NASA. Rear-mounted engines enable reduced nacelle drag, reduced noise for passengers, and can receive a propulsive efficiency boost due to Boundary Layer Ingestion (where turbulent air coming off the aircraft fuselage is ‘ingested’ into the propulsion system). Empowered by the freedom of distributed propulsion, designers may increasingly begin to advance designs from university classrooms and R&D labs into reality.

Final word

The technology is exciting, and implications for safety and the environment profound. There is still also plenty of room for development in the wider landscape; aircraft manufacturers and their associated technologies are only one piece of the puzzle, and for electrically-propelled aircraft to feature in everyday life all many stakeholders must play a role in the transition. Airports and airlines are key commercial stakeholders who are already beginning to show interest in taking up the technology. Solidifying the regulatory landscape will be another key objective to come.

Out of all the ambiguity at this stage, one thing is clear: we are now witnessing an age of innovation in aerospace and aviation of a type not seen for decades. Electrically propelled aircraft and their associated ecosystem are in their infancy, but advancing rapidly, and we at Roland Berger will continue to watch developments in the field closely.